KF Update – Charitable Giving

4 Minute Read

Strategies around charitable giving have evolved since the updates in the most recent tax law, specifically changes around the standard deduction. Far fewer people have the ability to itemize and take a tax deduction for their charitable gifts. That said, there are ways to utilize retirement accounts and gifting strategies to be charitable in a tax efficient manner.

If you are over 70.5, you can make what is called a Qualified Charitable Distribution to the qualified charity of your choice. As long as the money goes directly from a Pre-Tax IRA to the charity, you will not have to pay taxes on the distribution. If you are over 72, this distribution can be counted towards your Required Minimum Distribution.

As part of the 2020 CARES Act, individuals can now take a $300 above the line tax deduction for charitable gifts, so be sure to save those receipts!

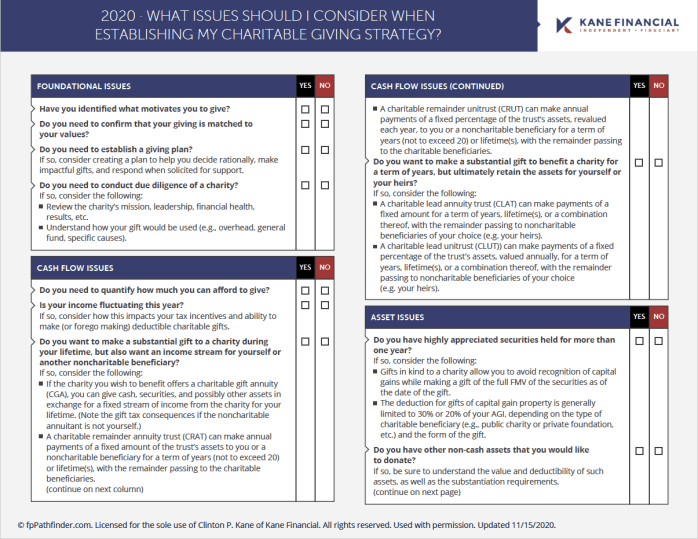

Below is a detailed checklist that you can go through to develop a gifting strategy and/or learn about ways to make charitable donations in a tax efficient manner. If you have any questions on this checklist, or would like to create a strategy, please contact the office and we will be glad to help with that process.

We wish you and your families a wonderful, healthy, and safe holiday season!